5 Misconceptions About Buying a Condo in Downtown Minneapolis vs. a Single-Family Home

Buying your first place in Minneapolis is exciting, but it also comes with a big decision: condo downtown or single-family home elsewhere? Many people assume they have to give up the vibrant downtown lifestyle and move to a suburban house in order to own a home.

In reality, a downtown condo can be a smart, comparable choice to a house. This article will walk you through common misconceptions about buying a condo in Downtown Minneapolis versus a single-family home, using real examples and research.

-

SAFETY DOWNTOWN MINNEAPOLIS

-

Condo Price Depreciation

-

HOA FEES

-

Space, Comfort, and Privacy

-

Ownership Means Life in the Suburbs

Downtown Condo vs. Single-Family Home

Consider a real-life example: a one-bedroom, one-bath condo in downtown Minneapolis (19 S 1st Street B904) was recently listed for about $149,900. It offers 710 square feet, modern amenities, and a walkable location next to the Mississippi River.

By contrast, a two-bedroom, one-bath single-family house in the McKinley area (3418 N 6th Street) is listed at around $230,000, offering 936 square feet and a small yard but at a higher price point.

This comparison highlights the trade-offs we’ll explore: cost, lifestyle, and “myths” that often surround condo buying in Downtown Minneapolis.

Misconception #1: “Downtown Minneapolis Isn’t Safe to Live In”

It’s understandable to worry about safety in any city center. High-profile news and outdated perceptions lead some to believe Downtown Minneapolis is dangerous for homeowners.

The reality is that downtown safety has been improving significantly. In early 2024, MN Daily cited that downtown Minneapolis crime was down 15–20% compared to the previous year. The trend continued into 2025 with city officials reporting a “significant decrease” in violent crime, including 47% fewer robberies, 40% fewer carjackings, and 32% fewer shooting victims in early 2025 vs early 2024, according to KSTP.

The data shows it’s far safer than many assume and getting better each month.

Thousands of people already live downtown peacefully, enjoying amenities like Nicollet Mall, the riverfront, and countless restaurants and theaters. In 2022–2023, downtown drew over 9 million people to concerts, sports, and events, with record-high hotel stays and transit rides fueling a lively atmosphere. Active streets are generally safe streets, and downtown’s resurgence in activity has cultivated a greater sense of safety.

Condo Added Safety Measures

Condo buildings often add extra peace of mind through secured entrances, cameras, and sometimes 24-hour staff. Many downtown Minneapolis condos are in well-lit, populated areas. You can feel comfortable walking to that cafe or catching an evening show.

Residents say they take simple precautions like avoiding certain quiet areas late at night or using the skyway system after dark, but overall, they feel safe living downtown. Don’t let outdated fears keep you from the downtown lifestyle you love. Minneapolis’s urban core is not the no-go zone some imagine. It’s a vibrant community that’s actively becoming safer and more welcoming.

Misconception #2: “Condos Depreciate in Price, They Don’t Appreciate Like Houses”

There’s a notion that buying a condo is a poor investment because it won’t grow in value like a single-family home might. This misconception likely stems from specific events (for example, downtown condo values dipping during the 2020 pandemic). However, over the long term, well-located condos generally do appreciate and build equity for their owners. They may appreciate at a different pace than detached houses, but it’s not true that they automatically depreciate.

Let’s look at some numbers:

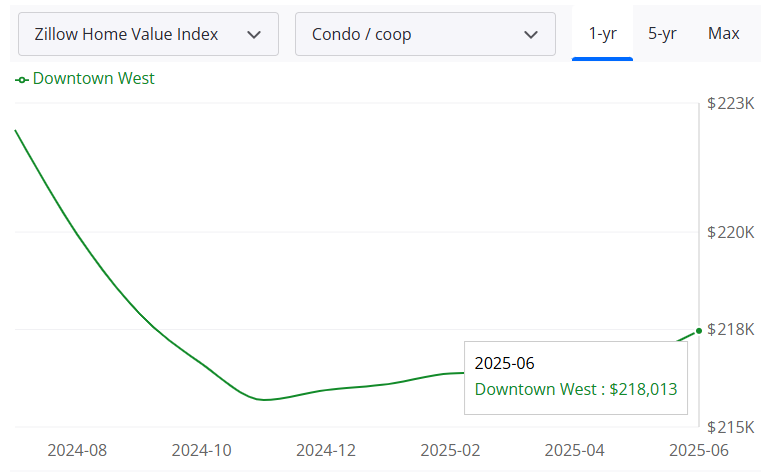

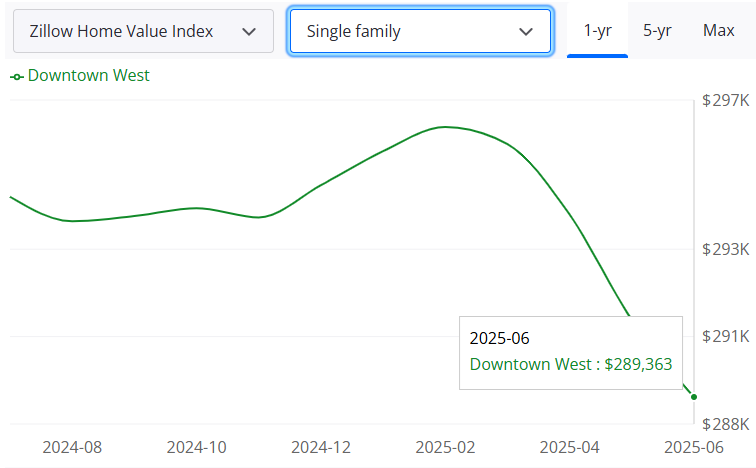

As of mid-2025, Zillow evaluated the median sale price for condos in the Downtown West Minneapolis market is just over $200,000, with an uptick in appreciation in the last couple of months, indicating they held their value even through recent market shifts.

In comparison, Zillow also shows that single-family homes in the Downtown West had a median price close to $300,000, with a drop in value over the last couple of months. Condos remain viable options for price-sensitive buyers entering the market.

Keep in mind, real estate appreciation depends on location, supply/demand, and condition more than the structure type. Downtown Minneapolis is limited in land and continuously attracting new employers, sports teams, entertainment, and residents, a recipe for property value stability.

Over the past few decades, Minneapolis home values (including condos) have risen significantly. Since 2020, Twin Cities metro home prices have been up about 24–25% overall, according to Minnesota Realtors. New upscale condo developments (and conversions of old warehouses to lofts) indicate confidence that downtown condo values will hold and grow.

A condo is real property; you own an actual piece of Minneapolis, and over time, it can absolutely appreciate. It’s not a glorified apartment. It’s an asset. If you maintain your unit and the HOA keeps the building in good shape, your condo can increase in value just like a house (especially as urban living remains popular).

Starting with a condo can be a stepping stone. You build equity that you could later use toward a larger home if desired. Don’t let the myth of “no appreciation” scare you off. Many condo owners have seen solid returns when they sell after several years.

Misconception #3: “HOA Fees Are Too Expensive and Not Worth It”

Ah, the HOA fee. Arguably, the biggest sticking point for condo skeptics. It’s true that condo owners pay a monthly homeowners association (HOA) fee that single-family homeowners do not. In the Twin Cities, these fees can range widely depending on the building and amenities. Some smaller condos might have HOA dues of around $250–$350 per month, whereas luxury high-rises with extensive amenities could charge $800+ per month. Seeing that bill, you might think: “Why would I pay that on top of my mortgage?!”

This is where perspective is needed. HOA fees cover a lot, and often save you money or hassle in other areas.

When you own a single-family house, you’re responsible for all maintenance, repairs, and utilities. With a condo, the HOA fee bundles many of those costs:

-

building insurance

-

professional management

-

exterior maintenance (roof, siding, windows)

-

landscaping and snow removal

-

water/sewer service

-

garbage pickup

-

and often amenities like a workout gym, pool, or 24-hour security staff.

HOA dues are paid to keep the property running and well-maintained. If your condo building has a gym and pool, for example, that could save you $50–$100 a month on gym memberships or community pool fees. If it includes a heated parking garage, you might save on car expenses or at least spare yourself the cost of a winter parking spot rental. Some condo HOAs even cover heating, A/C, or internet in the fee, which can be significant savings.

Consider a homeowner’s expenses

With a single-family home, you’ll have to consider: hiring a snow plow service or spending hours shoveling every big snowfall, paying for lawn care or investing your weekends mowing and gardening, fixing a leaky roof or replacing a 20-year-old furnace on your own dime.

Those costs can easily rival or exceed a few hundred dollars per month on average when spread over time. With a condo, all those headaches are handled for you. The HOA has a reserve fund for major repairs and insurance to cover damage, so you avoid surprise lump-sum bills that hit many homeowners (new roof = $10k+, new siding, foundation fixes, etc.).

Instead, you pay a predictable fee, and the association deals with coordinating the work.

Yes, HOA fees can increase over the years (they typically don’t go down unless a special assessment ends), but so do property taxes and costs for maintaining an older house. At least with a condo, you have a board and community voting on how to manage those expenses, and any increases usually reflect added value or necessary upgrades to protect everyone’s investment.

To make sure an HOA’s fees are “worth it,” do your homework

Review what’s included, the association’s budget and reserve funds, and any upcoming projects.

A well-run HOA in a newer building might have stable fees and a healthy reserve (good sign!), whereas a very low fee could be a red flag that the building isn’t setting aside funds for big repairs. It’s similar to how you’d inspect a house before buying; you should inspect a condo’s HOA finances.

HOA fees are not throw-away money; they’re a reallocation of housing costs. You’re paying for convenience, maintenance, and amenities in one package. If you value your time (and peace of mind), many find it well worth it. And remember, even single-family homes sometimes have HOA fees if they’re in a planned community or townhome development, so this isn’t exclusively a condo issue.

Misconception #4: “Condos Mean Sacrificing Space, Comfort, and Privacy”

It’s true that a typical condo will have less square footage and no private yard compared to a suburban single-family home. However, condo living doesn’t automatically equal cramped or uncomfortable living, especially in Minneapolis, where many condos are quite spacious and thoughtfully designed. While you do share walls, modern condo buildings balance privacy and community better than you might expect.

Space

First, consider size and layout. Downtown Minneapolis condos come in all shapes and sizes. You can find cozy one-bedrooms and expansive three-bedroom condos or penthouse units that rival the square footage of a house. Some condos in converted warehouses have 1,500–2,000+ sq ft lofts with high ceilings and open layouts. You won’t get a basement or an attic, but smart storage solutions (and available storage lockers in many buildings) can compensate.

Condo dwellers often benefit from amenities as “extra” space: a party room for gatherings, a rooftop deck or courtyard to relax outdoors, a guest suite for visitors, etc.

These shared facilities extend your living area without the responsibility of maintaining them yourself. In a way, the city itself becomes your backyard with downtown parks, trails along the Mississippi River, and cafes at your doorstep; you’re not confined to your unit for space or recreation.

Privacy

It’s true that a standalone house offers maximum privacy (no shared walls, your own yard). In a condo, you will have neighbors nearby and HOA rules to follow. However, many people find that Minneapolis condo communities strike a nice balance between privacy and social opportunity.

Well-built condos have sound-insulated walls and floors, so you’re not overhearing your neighbor’s every move (far from the paper-thin apartment stereotype). You can also control your immediate interior space as you like – paint, decorate, renovate the kitchen – with far fewer limitations than a rental. (HOA rules mainly cover exterior appearance and common areas; inside your unit, you generally have freedom as long as you don’t mess with structural elements or disturb others.)

Freedom

Homeownership in any form comes with responsibilities. With a house, you have the freedom to plant a garden or renovate as you please, but you’re also free to deal with every leaky faucet, fallen tree, or property tax hike on your own. In a condo, you might need permission for certain modifications, but you’re free from a lot of upkeep.

For many busy professionals or downsizers, not having to worry about mowing, snow shoveling, or fixing a broken furnace is a huge lifestyle upgrade. And if you’re the DIY type who enjoys home projects, keep in mind you can still personalize a condo interior. You might not be building a deck in the backyard, but you could be customizing a home office with that extra time instead.

As for lifestyle freedoms, consider that condo living frees you from maintenance chores, giving you more time to enjoy hobbies, go out with friends, or travel without worrying who will mow the lawn. Many downtown condo residents love that they can lock-and-leave for a weekend getaway without a second thought, something homeowners often can’t do so easily.

Family and pets

Some assume condos are only for singles or young couples, but families and pet owners can and do live downtown happily. Many buildings are pet-friendly.

Minneapolis’s downtown and surrounding neighborhoods have playgrounds, schools, and family-friendly events. City living isn’t just for nightlife; it can be for raising kids with museums and libraries around the corner. If having a private yard for kids or dogs is non-negotiable, then a condo might not fulfill that. But plenty of urban parents make it work and appreciate exposing their kids to the city’s cultural assets.

It comes down to personal preference: yard and space vs. location and convenience. Would you rather have a backyard of your own, or walk a couple of blocks to beautiful Loring Park or Gold Medal Park? Neither choice is “right” for everyone, but it’s inaccurate to say choosing a condo means a poor quality of life. For many, it’s a richer life because they spend weekends exploring the city instead of doing home projects.

Misconception #5: “If I Want to Own a Home, I Have to Leave Downtown.”

Perhaps the overarching misconception is this: Homeownership = moving to the suburbs.

I often hear from downtown Minneapolis renters who love their lifestyle but assume that to buy a place, they’ll need to “graduate” to a house in a far-flung neighborhood. This simply isn’t true. You can absolutely own a home and stay in the city you love. A condominium is homeownership: you get a deed, you build equity, and you have a place to call your own, all while staying in the urban core. If maintaining a downtown lifestyle is a priority for you, a condo allows you to do that and start investing in your future.

Consider how financially attainable condos can be

We saw in our example that a downtown 1-bedroom condo was listed around $150K, whereas a single-family home in the city was $230K and many suburban homes now often cost $400K, $500K or more for a starter home. The median condo price ($200K) is nearly half the median single-family home price in Minneapolis. That translates to a lower down payment, making ownership feasible sooner rather than later.

Minneapolis was recently ranked among the top 3 cities for first-time homebuyers nationwide according to Yahoo Finance.

The recognition comes in part due to its affordable condo and starter home options and strong market stability (Minneapolis’ home prices have seen only modest increases in recent years, avoiding the huge spikes seen elsewhere). This is great news if you’re renting downtown and worried about being “priced out” of owning. You might find a condo that costs the same or even less per month than your rent, especially when factoring in Minneapolis’s relatively stable prices and potential first-time buyer programs.

By buying a condo downtown, you get to keep your walkable commute, favorite coffee shop around the corner, Twins games in the summer, and theatre nights in the winter. At the same time, you’re investing in property and building equity with each mortgage payment (instead of paying a landlord).

You’re also avoiding some costs that suburban homeowners face: long commutes (think gas and time savings when you can walk/bike or use transit), possibly a second car (many city dwellers find one car or no car suffices), and the temptation to spend weekends at Home Depot for house projects. Your budget for entertainment and dining out can remain intact because you didn’t have to stretch to buy a more expensive house or spend all your free time on yard work.

There’s also an environmental angle here: living in a condo can be more sustainable (shared building resources, using transit, etc.), which might resonate if you value a green lifestyle.

Overcoming the “Suburban Pressure”

Culturally, some people feel that owning a single-family house is the only “legitimate” way to own a home. Urban homeownership via condos or townhouses is increasingly common and respected. Downtown Minneapolis has a thriving community of homeowners in high-rises and historic lofts alike. These folks have built strong neighborhood associations and social networks; they’re deeply invested (literally and figuratively) in the city’s future. By choosing a condo, you’re joining that community of city homeowners, showing that you can have roots in downtown.

If your concern is that you might “outgrow” a condo, remember that not all houses are forever homes either.

People often move as their needs change. You could start with a condo in your 20s or 30s, gain equity, then decide later if you want a house (perhaps when needing more space for kids). Or you might love condo life so much you stay long-term and perhaps move into a larger downtown unit as they become available. There’s flexibility, and buying a condo now doesn’t lock you out of any future options – it only opens more doors by building your wealth.

.jpeg)

Final Thoughts: Condo or House – It’s About Your Priorities

Choosing between a downtown condo and a single-family home comes down to what you value most in your lifestyle.

Single-family homes offer independence, extra space, and perhaps a big backyard – great perks for those who prioritize privacy and room to grow. However, they also come with higher prices (in Minneapolis’ market) and all the responsibilities of upkeep.

Condos, on the other hand, provide convenience, amenities, and a location in the heart of the action, often at a lower cost of entry. You trade a bit of private space for shared benefits and low-maintenance living.

If you’ve been avoiding condos due to safety myths, financial fears, or lifestyle worries, hopefully ,this discussion has shown that those concerns can be managed or are outright misconceptions. Downtown Minneapolis condos can offer a fantastic quality of life – a way to have your city cake and eat it too (equity and urban fun!). Before you decide, take a realistic look at your budget and how you like to spend your time.

Tour some condo open houses and some single-family homes in your price range.

You might be surprised: the condo could feel more “you” than you expected. Run the numbers on total monthly costs:

mortgage + HOA vs. mortgage + utilities/maintenance.

You’ll likely find the gap isn’t as wide as the sticker prices suggest.

Schedule a tour by visiting specific listings or click here.

Where you start (condo or house) is not where you have to end up. The important thing is getting a home that fits your life now, in a community where you feel happy and safe. For many Minneapolis buyers, that means a condo downtown is the perfect first (or next) home.

If you want a broader look at the pros and cons of single-family homes versus homes in HOA-governed communities (like condos or townhomes), check out the DRG Real Estate Blog article “Choosing Between a Single-Family Home and a Home in an HOA Community”. It offers a point-by-point comparison to help you determine which option best suits your lifestyle and priorities.

Sources: Recent market data and reports were used to provide accurate comparisons and debunk myths. For instance, crime statistics from city officials and local media demonstrate improved downtown safety. Housing market insights were drawn from Minneapolis-area real estate reports and Realtor associations.

For more information and to start a conversation, reach out to Joe@DRGMpls.com or 612.244.6613. I'd be happy to connect!

Posted by Joe Grunnet on

.jpeg)

Leave A Comment